[ad_1]

As the Indian Premier League (IPL) juggernaut rolls on and promises to capture the imagination of millions of fans across the world for the 17th year, the T20 spectacle also continues to almost single-handedly drive the Indian sports industry.

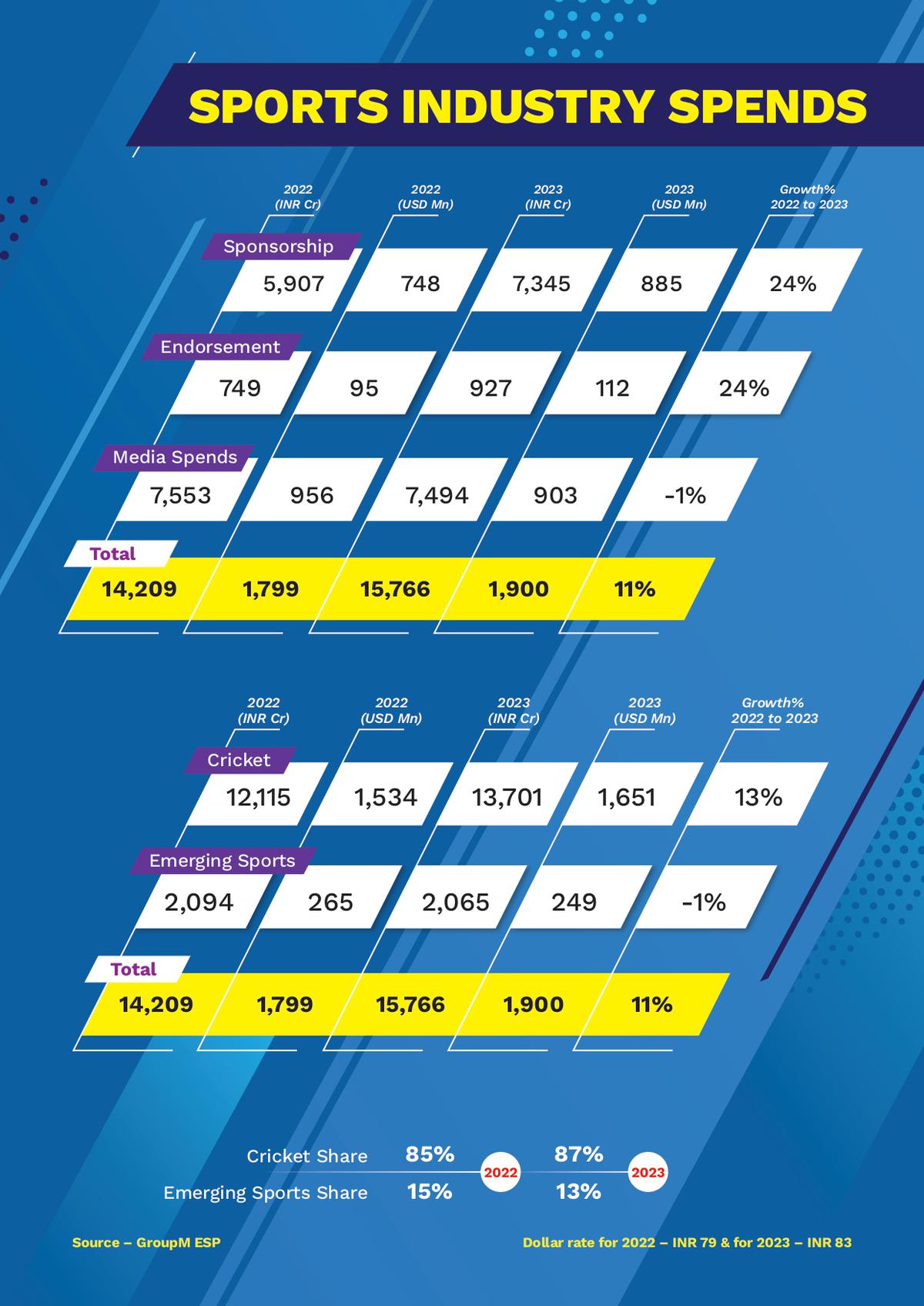

According to the latest edition of the ‘India Sports Sponsorship Report’ published by GroupM ESP, the industry has swelled 6.5 times since the IPL boom in 2008. Its revenue from sponsorship, endorsement, and advertising spending has grown from Rs. 2,423 crore in 2008 to a whopping Rs. 15,766 crore in 2023. Remarkably, this is the first time the industry has breached the 15,000-crore mark.

Cricket has been the driving the Indian sports industry.

| Photo Credit:

GROUPM ESP

Cricket has been the driving the Indian sports industry.

| Photo Credit:

GROUPM ESP

The bulk of the heavy lifting has been done by cricket, which contributed an astounding 87 per cent (Rs. 13,701 crore) of the total industry spends in sports in India, recording a healthy 13 percent growth from 2022 (Rs. 12,115 crore).

This massive upsurge in the commercialization of the most popular sport in India was largely driven by the IPL, whose brand value has ballooned by 433 per cent since its inception in 2008.

“While the IPL system has grown in brand valuation by 433 per cent, the learning curve gained by the industry through this ultra-competitive cricket league has had a snowballing effect on Indian sports. The past decade has witnessed a six-fold increment in the industry, including cricket and emerging sports,” says Vinit Karnik, head of entertainment, esports and sports at GroupM South Asia.

The growth in spending in cricket was sparked by the intense bidding war between Viacom and Disney, who secured the digital and TV rights, respectively, for the IPL for Rs. 23,758 crore and Rs. 23,575 crore for the 2023-27 cycle. In sharp contrast, Star had bagged both TV and digital rights for Rs. 16,347 crore for the 2018-2022 period.

The media rights sale for different platforms resulted in a per-match valuation of Rs. 118.5 crore for the IPL, second only to the National Football League (NFL), whose corresponding figure stands at Rs. 141 crore.

Zooming into the granular data, the growth in sports spending in India was spurred by sponsorship and endorsement, which grew by 24 per cent each, even as media spending, which accounts for advertising on TV, digital and print, dropped.

Cricket again enjoyed the lion’s share in sports sponsorship spending, contributing 79 per cent to the total revenue of Rs. 7,345 crore recorded in 2023 and growing by 32 per cent over 2022. Even though ground sponsorship maintained its traditional sway, accounting for more than 40 per cent of the total proceeds from sponsorship spending, it only grew by six per cent from 2022 to 2023.

In contrast, franchise fee registered a 60 per cent growth in 2023, and the inaugural Women’s Premier League (WPL) played a significant part, fetching the Board of Control for Cricket in India (BCCI) a revenue of Rs. 4,669 crore.

Cricket enjoyed the lion’s share in sports sponsorship spending.

| Photo Credit:

GROUPM ESP

Cricket enjoyed the lion’s share in sports sponsorship spending.

| Photo Credit:

GROUPM ESP

The IPL continued its outsized dominance in 2023, accounting for more than half (over Rs. 3,000 crore) of the sponsorship spending on cricket. The 10-team format, introduced in 2022, continued to pay dividends as a higher number of matches contributed significantly to proceeds from central, team and franchise spending.

The Indian men’s cricket team, too, raked in the moolah in a packed international calendar, which included the ODI World Cup, as IDFC First Bank and Adidas came on board as title sponsor and kit sponsor, respectively.

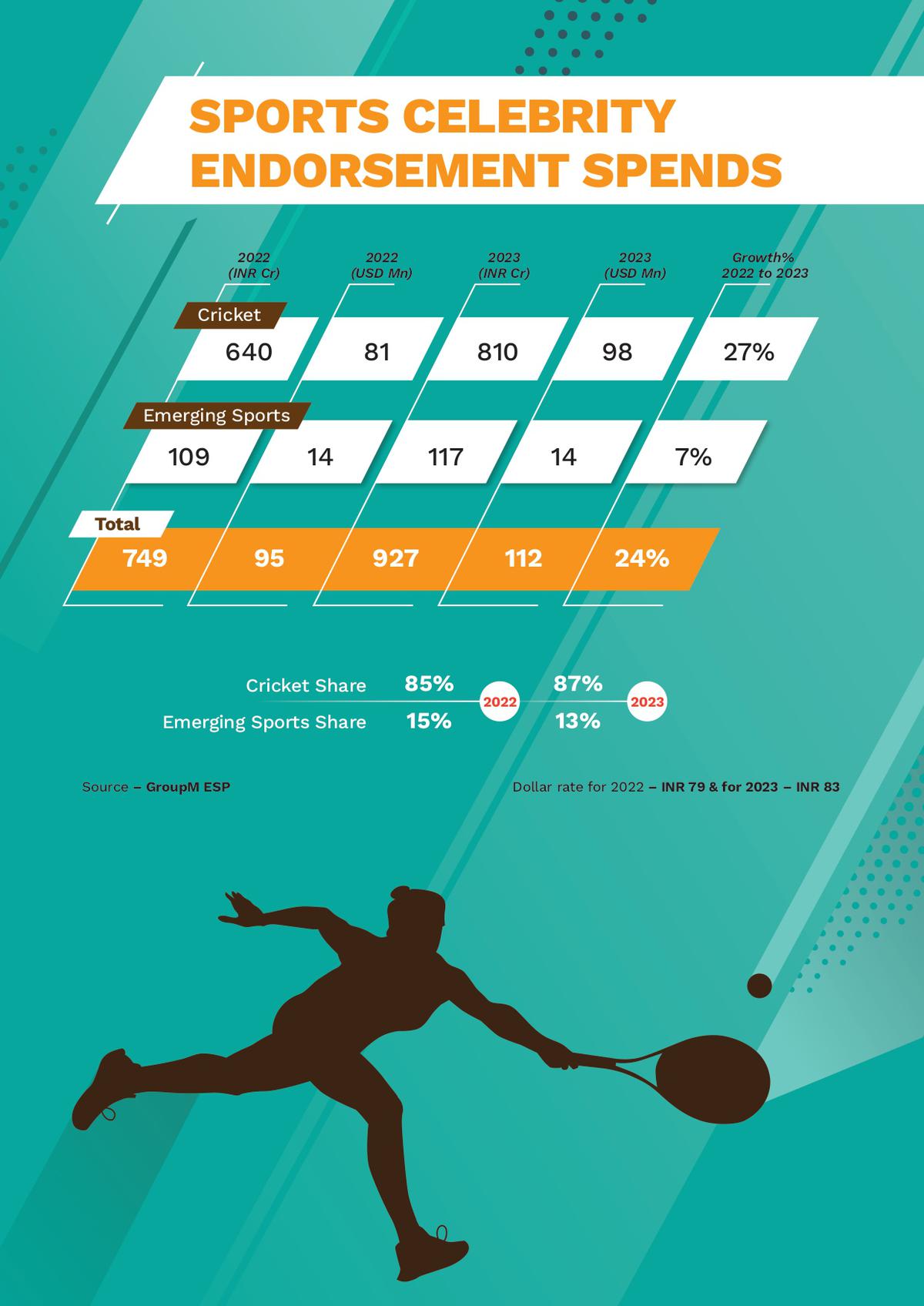

Athlete endorsements, which grew at the same pace as sponsorship in 2023, again saw cricketers pull away from the pack significantly. Out of the 536 endorsement deals that went to Indian athletes in 2023, 380 were snapped up by cricketers alone.

Virat Kohli, MS Dhoni and Rohit Sharma together signed up for more than 30 brands, while Shubman Gill, Hardik Pandya, Jasprit Bumrah and KL Rahul also made significant gains. In total, endorsement deals made cricketers richer by 27 per cent in 2023 compared to the previous year, with the sport enjoying an 87 per cent share in endorsement spending.

Cricketers pulled away from the pack in the endorsements segment too.

| Photo Credit:

GROUPM ESP

Cricketers pulled away from the pack in the endorsements segment too.

| Photo Credit:

GROUPM ESP

The only category of sports spending that witnessed a degrowth in 2023 was advertising on sports-related content. Even here, cricket held its own, registering an identical share of 94 per cent in 2023 compared to 2022.

Despite a fall of Rs. 59 crore in spending in 2023, media spending still accounts for the largest share (over 47 per cent) in sports commercialization in the country.

It is also in this segment where the tectonic shifts, facilitated by advances in technology, are most visible. While TV advertising still comprises more than 50 per cent of the total media spending, it fell by 16 per cent in 2023, even as the share of digital swelled by 40 per cent.

Digital media spending has picked up pace at a rapid rate.

| Photo Credit:

GROUPM ESP

Digital media spending has picked up pace at a rapid rate.

| Photo Credit:

GROUPM ESP

This shift was visible during IPL 2023 too, where TV ads spending declined but digital spending grew by 25 percent. Print advertising continues to lag, witnessing negligible growth – going from Rs. 2 crore in 2022 to Rs. 4 crore in 2023.

The most significant gains were made by franchise fee revenue in the sponsorship bracket and digital revenue in the media spends segment. Interestingly, both shifts in market dynamics were facilitated by the advent of the IPL – which introduced the franchise model back in 2008 and witnessed separate sales for TV and OTT (Over-the-Top) rights in 2023.

“The IPL and Team India fixtures are eagerly awaited sporting events for people across demographic profiles, enthralling the fans with the finest quality of on-field action. The famous cricketers in our country are household names – they are brands unto themselves! These remarkable athletes have the power to connect with the Indian consumers, which makes them worthy ambassadors for some of the most influential brands in the country,” Prasanth Kumar, CEO of GroupM South Asia, says.

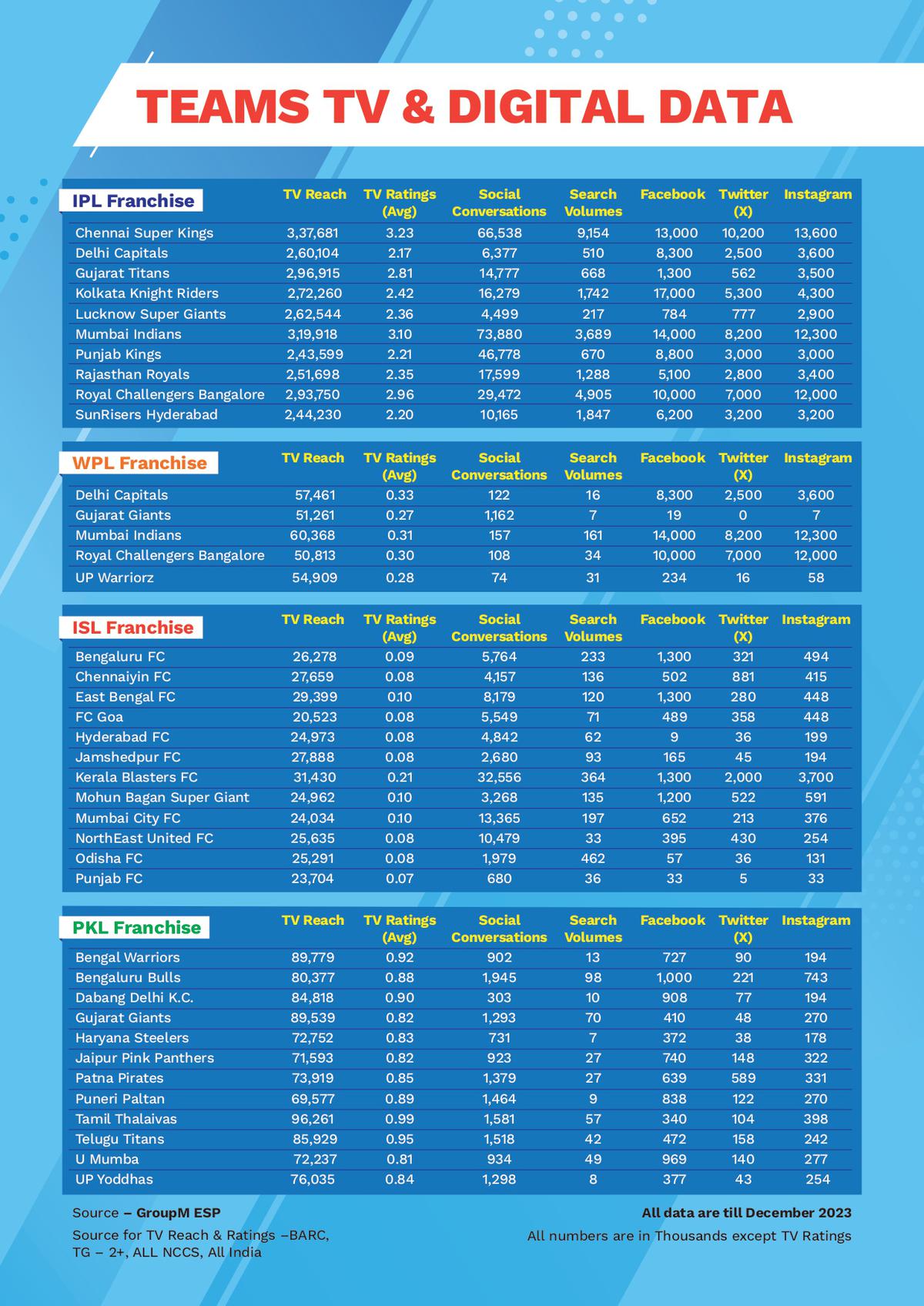

Some IPL franchises individually enjoy a greater TV and digital reach than the ISL put together.

| Photo Credit:

GROUPM ESP

Some IPL franchises individually enjoy a greater TV and digital reach than the ISL put together.

| Photo Credit:

GROUPM ESP

Investment will naturally follow the fans, who overwhelmingly seem to be hooked on the T20 blitz. Going by the team-wise TV and digital data, IPL franchises such as Chennai Super Kings, Mumbai Indians and Royal Challengers Bangalore individually trump the numbers of the Indian Super League (ISL) as a whole on most metrics such as TV reach, TV ratings, search volumes, and social media platforms such as Facebook, Twitter (X), and Instagram.

[ad_2]